Absolutely! Here’s a 2700-word article about owner financing interest rates, formatted with `

` and `

` tags instead of “ tags.

Owner financing, also known as seller financing, is a creative real estate transaction where the seller acts as the lender, providing financing to the buyer. This approach can be beneficial for buyers who struggle to qualify for traditional bank loans, and for sellers looking to expedite a sale or earn a higher return on their investment. One of the most critical aspects of owner financing is the interest rate. This article delves into the intricacies of owner financing interest rates, covering everything from factors influencing them to negotiation strategies.

Understanding Owner Financing

Owner financing occurs when a seller agrees to finance the purchase of their property for the buyer. This arrangement typically involves a promissory note, which outlines the terms of the loan, including the interest rate, loan amount, payment schedule, and any penalties for default. This method can be particularly attractive in markets where traditional lending is tight or when buyers have unique financial situations.

What is a Promissory Note?

A promissory note is a legal document that details the terms of the loan between the seller (lender) and the buyer (borrower). It serves as a written promise to repay the loan under specific conditions. Key components of a promissory note include:

Loan amount (principal)

Benefits of Owner Financing

For buyers, owner financing can offer:

Flexibility in qualifying for a loan.

For sellers, it can provide:

A higher sales price.

Factors Influencing Owner Financing Interest Rates

Several factors determine the interest rate in owner financing. Understanding these factors is crucial for both buyers and sellers to negotiate fair terms.

Current Market Interest Rates

The prevailing market interest rates for traditional mortgages serve as a benchmark. Sellers often base their rates on these figures, adjusting for the perceived risk. If conventional mortgage rates are high, owner financing rates will likely be higher as well, and vice versa.

Buyer’s Creditworthiness

A buyer’s credit score and financial history play a significant role. Buyers with lower credit scores or a history of financial instability are considered higher risk, and sellers may charge higher interest rates to compensate.

Property Type and Condition

The type and condition of the property can also influence the interest rate. Properties in high-demand areas or in excellent condition may warrant lower rates, while those in less desirable locations or in need of repairs may result in higher rates.

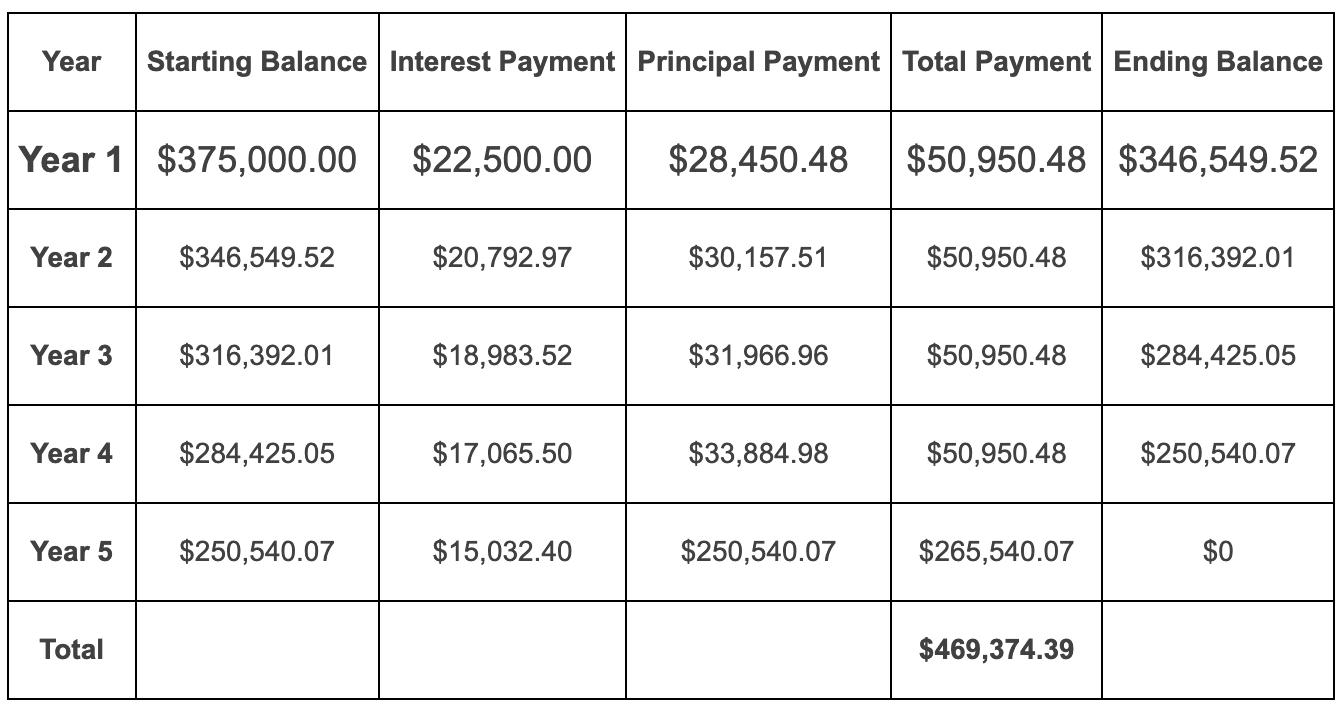

Loan Term and Amortization

The length of the loan term and the amortization schedule affect the overall risk. Shorter loan terms or balloon payments may lead to lower interest rates, while longer terms may result in higher rates to account for the increased risk over time.

Down Payment Amount

A larger down payment reduces the seller’s risk, which can lead to a lower interest rate. A smaller down payment increases the risk, potentially resulting in a higher rate.

Seller’s Motivation

The seller’s motivation for offering financing can also influence the interest rate. If the seller is highly motivated to sell quickly, they may offer a lower rate. Alternatively, if they are primarily interested in generating income, they may charge a higher rate.

Local Real Estate Market Conditions

The overall health of the local real estate market can impact interest rates. In a seller’s market, rates may be higher due to increased demand. In a buyer’s market, rates may be more negotiable.

Negotiating Owner Financing Interest Rates

Negotiation is a key part of owner financing. Both buyers and sellers should be prepared to discuss and compromise on the interest rate.

Researching Market Rates

Before entering negotiations, buyers should research current market interest rates for traditional mortgages and similar owner-financed deals. This information provides a basis for comparison and helps determine a fair rate.

Assessing Risk and Offering Collateral

Buyers can reduce the perceived risk by providing a larger down payment or offering additional collateral. Demonstrating financial stability and a solid repayment plan can also help negotiate a lower rate.

Understanding the Seller’s Perspective

Sellers should understand the buyer’s financial situation and motivation. A fair interest rate that aligns with market conditions and the buyer’s ability to pay is more likely to result in a successful transaction.

Considering Alternative Financing Options

Buyers should explore alternative financing options, such as private lenders or hard money loans, to compare interest rates and terms. This provides leverage during negotiations with the seller.

Using a Real Estate Attorney

Both buyers and sellers should consider using a real estate attorney to draft and review the promissory note. An attorney can ensure that the terms are fair and legally sound, protecting both parties’ interests.

Including Contingencies

Including contingencies in the agreement can protect both parties. For example, a contingency that allows the buyer to refinance with a traditional lender after a certain period can provide flexibility and reduce risk.

Legal and Tax Implications

Owner financing has legal and tax implications that both buyers and sellers should be aware of.

Usury Laws

Usury laws limit the maximum interest rate that can be charged on a loan. Sellers must ensure that their rates comply with these laws to avoid legal issues.

Tax Implications for Sellers

Sellers who offer financing may be able to take advantage of installment sales, which allow them to spread out the capital gains tax over the life of the loan. They will also need to report the interest income received from the buyer.

Tax Implications for Buyers

Buyers may be able to deduct the interest paid on owner-financed loans, similar to traditional mortgage interest deductions. They should consult with a tax professional to understand the specific rules and regulations.

Due-on-Sale Clauses

If the seller has an existing mortgage on the property, the lender may have a due-on-sale clause, which requires the seller to pay off the mortgage when the property is sold. Sellers should address this issue before offering owner financing.

Land Contracts vs. Mortgages

There are different legal methods for owner financing. Land contracts and mortgages are common. Knowing the differences is important. A land contract gives the buyer equitable title until the loan is paid off, while a mortgage gives immediate legal title.

Practical Tips for Buyers and Sellers

Here are some practical tips to ensure a smooth owner financing transaction.

For Buyers:

Conduct thorough due diligence on the property.

For Sellers:

Screen potential buyers carefully.

Conclusion

Owner financing can be a valuable tool for both buyers and sellers in the real estate market. Understanding the factors that influence interest rates, negotiating effectively, and being aware of the legal and tax implications are essential for a successful transaction. By following the guidelines outlined in this article, both parties can navigate the complexities of owner financing and achieve their real estate goals.