Absolutely! Here’s a 2700-word article about mini finance calculators, structured with `

` and `

` tags in place of “ for improved readability and hierarchy:

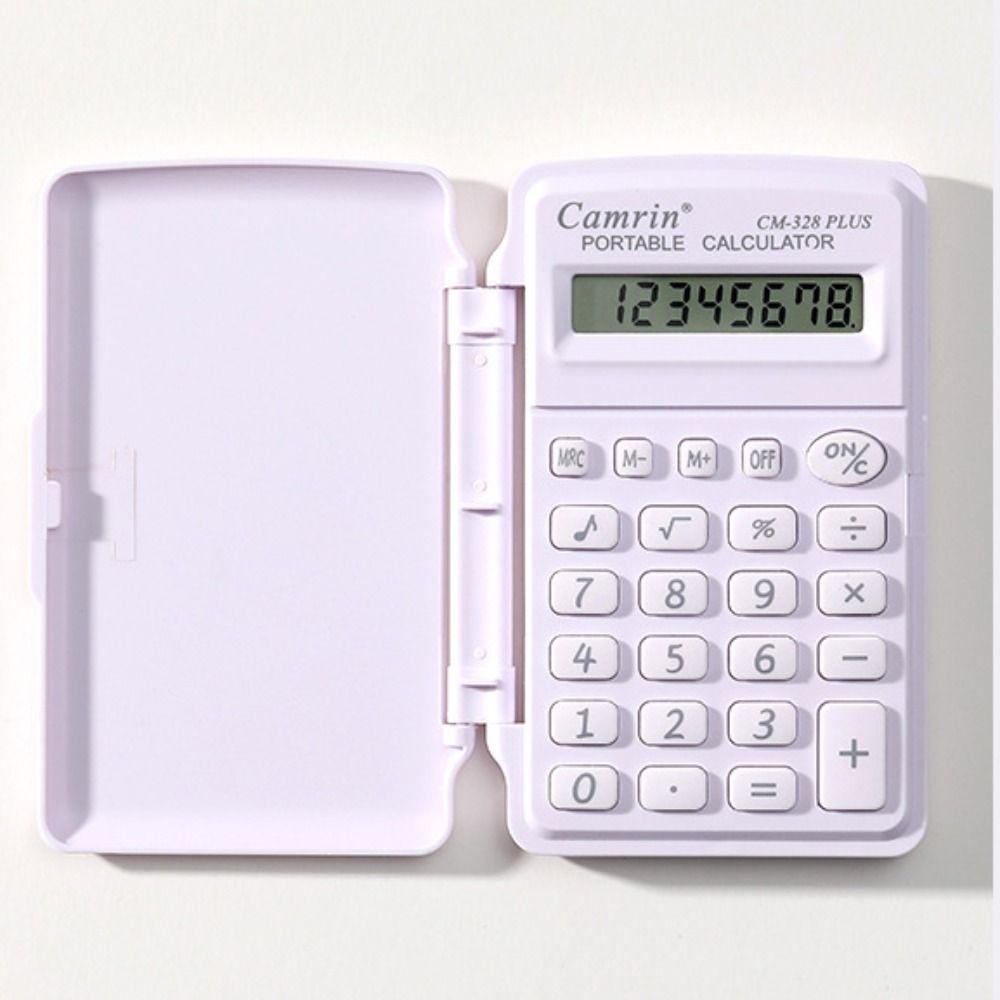

In today’s fast-paced world, quick access to financial information is crucial. Whether you’re planning a budget, considering a loan, or saving for retirement, a mini finance calculator can be an invaluable tool. These compact, often free, digital tools provide instant calculations, empowering you to make informed financial decisions without the complexity of spreadsheets or advanced financial software.

Mini finance calculators are streamlined versions of comprehensive financial tools, designed for ease of use and immediate results. They typically focus on specific financial calculations, such as loan payments, savings growth, or investment returns. Their portability and accessibility make them perfect for on-the-go financial planning.

Simplicity and Speed

Mini calculators are designed for simplicity. They eliminate the need for complex formulas and financial jargon, providing instant results with minimal input. This speed is especially useful when comparing different financial scenarios quickly.

Accessibility and Portability

Most mini finance calculators are available online or as mobile apps, making them accessible from anywhere with an internet connection. This portability allows you to make financial decisions on the spot, whether you’re at a store, a car dealership, or simply on the go.

Empowerment and Informed Decision-Making

By providing clear and concise calculations, mini finance calculators empower you to understand the financial implications of your choices. This knowledge can lead to better budgeting, smarter investments, and more effective debt management.

There is a wide variety of mini finance calculators, each tailored to specific financial needs. Here are some of the most common types:

Loan Calculators

Mortgage Calculators

These calculators help you determine your monthly mortgage payments based on the loan amount, interest rate, and loan term. They can also show you the total interest paid over the life of the loan.

Auto Loan Calculators

Similar to mortgage calculators, auto loan calculators help you estimate monthly payments for car loans. They can also factor in down payments and trade-in values.

Personal Loan Calculators

These calculators help you calculate payments for personal loans, which can be used for various purposes such as debt consolidation, home improvements, or medical expenses.

Savings and Investment Calculators

Savings Goal Calculators

These calculators help you determine how much you need to save each month to reach a specific financial goal, such as a down payment on a house or a vacation.

Compound Interest Calculators

These calculators illustrate the power of compound interest, showing how your savings can grow over time with regular contributions and interest earnings.

Retirement Calculators

These calculators help you estimate how much you need to save for retirement based on your current age, income, and desired retirement age.

Budgeting and Financial Planning Calculators

Budget Calculators

These calculators help you create a budget by tracking your income and expenses. They can also help you identify areas where you can cut back on spending.

Debt Consolidation Calculators

These calculators help you determine if debt consolidation is a good option for you by comparing your current debt payments to the potential payments of a consolidated loan.

Tax Calculators

Simple tax calculators can give rough estimates of tax burdens, based on income and deductions.

Gather Accurate Information

The accuracy of your calculations depends on the accuracy of the information you input. Make sure you have the correct loan amount, interest rate, and loan term before using a loan calculator. For savings calculators, ensure you know your current savings, interest rate, and desired savings goal.

Understand the Assumptions

Mini finance calculators often make certain assumptions, such as a fixed interest rate or regular contributions. Be aware of these assumptions and how they might affect your results.

Compare Different Scenarios

Use the calculator to compare different financial scenarios. For example, try different loan terms or interest rates to see how they affect your monthly payments. Or, experiment with different savings amounts to see how they impact your savings growth.

Use Multiple Calculators

Don’t rely on just one calculator. Use multiple calculators to cross-check your results and get a more comprehensive view of your financial situation.

Review and Adjust Regularly

Your financial situation can change over time. Review your calculations regularly and adjust your plans as needed. This will help you stay on track and achieve your financial goals.

Quick and Easy Calculations

Mini calculators provide instant results without the need for complex formulas or software.

Improved Financial Literacy

By using these calculators, you can gain a better understanding of financial concepts and how they apply to your own situation.

Better Financial Planning

Mini calculators can help you create realistic financial plans and track your progress towards your goals.

Reduced Stress and Anxiety

By having a clear understanding of your finances, you can reduce stress and anxiety related to money management.

Simplified Calculations

Mini calculators often simplify complex financial calculations, which may not be suitable for all situations.

Lack of Customization

These calculators may not offer the same level of customization as advanced financial software.

Potential for Errors

If you input incorrect information, the calculator will produce inaccurate results.

Not a Substitute for Professional Advice

While mini finance calculators can be helpful, they should not be used as a substitute for professional financial advice.

Identify Your Needs

Determine what type of financial calculations you need to perform. This will help you choose the right calculator.

Look for User-Friendly Interfaces

Choose a calculator with a clear and intuitive interface that is easy to use.

Check for Accuracy and Reliability

Ensure that the calculator is accurate and reliable by comparing its results to other sources.

Read Reviews and Recommendations

Read reviews and recommendations from other users to get a sense of the calculator’s quality and performance.

Consider Mobile Apps

If you need to access your calculator on the go, consider using a mobile app.

Online Mortgage Calculators

Many banks and financial websites offer free online mortgage calculators.

Mobile Budgeting Apps

Apps like Mint and Personal Capital offer budgeting tools and calculators.

Investment Calculators

Websites like Investor.gov and CalculatorSoup offer a variety of investment calculators.

Mini finance calculators are powerful tools that can help you make informed financial decisions quickly and easily. By understanding their benefits and limitations, and by choosing the right calculator for your needs, you can leverage these tools to achieve your financial goals. Whether you’re planning for a mortgage, saving for retirement, or simply budgeting your expenses, a mini finance calculator can be a valuable asset in your financial toolkit. Remember to always double check inputs and consider the assumptions being made.