Absolutely! Here’s a comprehensive article about Mercedes-Benz finance rates, structured with `

` and `

` headings for better readability, and aiming for around 2700 words.

Owning a Mercedes-Benz is a dream for many, symbolizing luxury, performance, and prestige. However, the path to putting a three-pointed star in your driveway often involves navigating the complexities of automotive financing. Understanding Mercedes-Benz finance rates is crucial for making informed decisions and securing the best possible deal.

Understanding Mercedes-Benz Financial Services

Mercedes-Benz Financial Services (MBFS) is the captive finance arm of Mercedes-Benz USA. It provides a range of financing and leasing options specifically tailored for Mercedes-Benz vehicles. MBFS aims to simplify the purchasing process, offering competitive rates and flexible terms.

What is a Captive Finance Company?

A captive finance company is a lending institution owned by a vehicle manufacturer. These companies often offer specialized programs and incentives that may not be available from traditional banks or credit unions. For Mercedes-Benz, MBFS provides a direct link to the brand, potentially offering exclusive deals and a deeper understanding of the vehicles they finance.

The Role of MBFS in the Purchasing Process

MBFS plays a vital role in facilitating Mercedes-Benz purchases. They handle everything from loan origination and lease agreements to insurance products and extended warranties. Their goal is to provide a seamless and convenient financing experience for customers.

Factors Influencing Mercedes-Benz Finance Rates

Several factors determine the finance rates offered by MBFS and other lenders. Understanding these factors can help you anticipate and potentially improve your rate.

Credit Score and History

Your credit score is the most significant factor influencing your finance rate. A higher credit score generally translates to lower interest rates. MBFS, like other lenders, uses credit scores to assess your creditworthiness and risk.

How Credit Scores Impact Rates

Excellent Credit (750+): Typically qualifies for the lowest available rates and best terms.

Loan Term

The length of your loan term also affects your interest rate. Longer loan terms may result in lower monthly payments but higher overall interest paid. Shorter terms typically have higher monthly payments but lower total interest.

Choosing the Right Loan Term

Consider your budget and financial goals.

Down Payment

A larger down payment can reduce the loan amount, leading to lower monthly payments and potentially lower interest rates. It also demonstrates financial stability to the lender.

Benefits of a Larger Down Payment

Reduces the loan-to-value (LTV) ratio.

Vehicle Model and Year

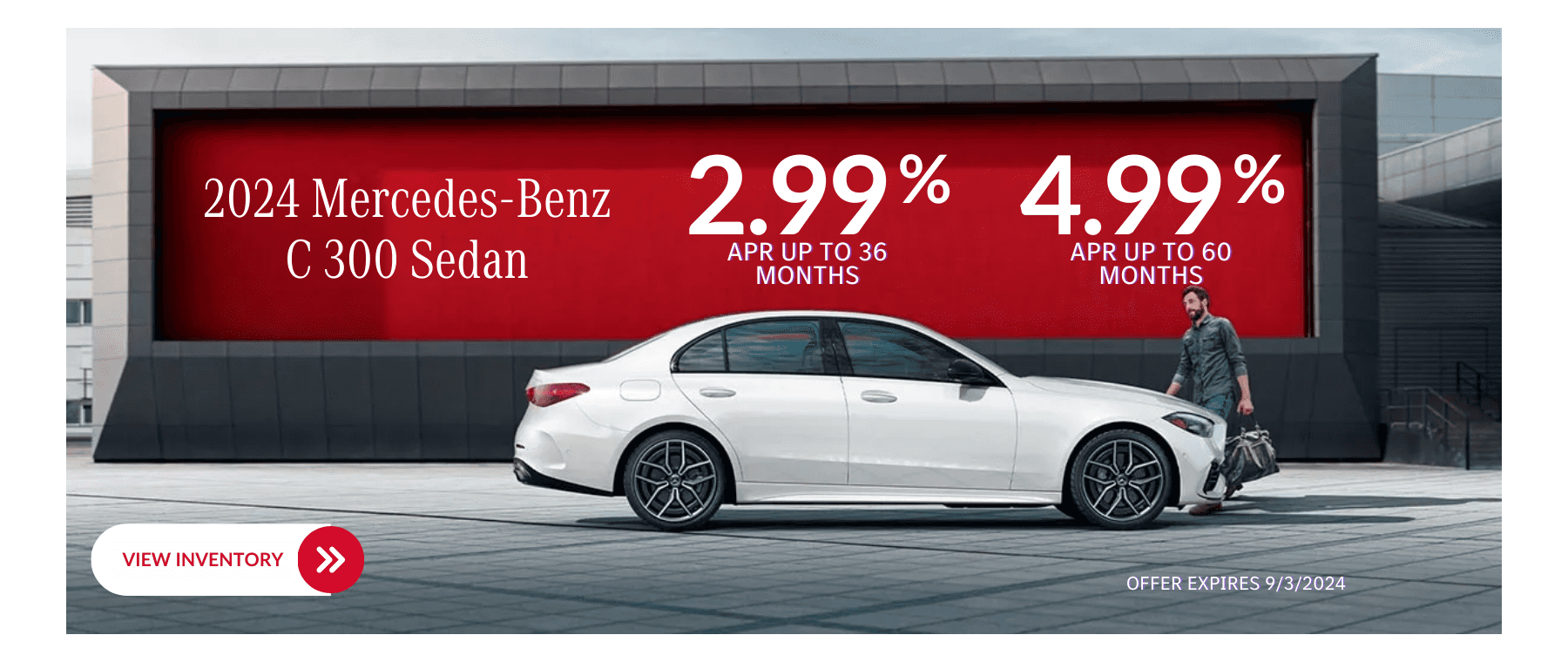

New and certified pre-owned (CPO) Mercedes-Benz vehicles may qualify for special financing rates or incentives. Older used models may have higher rates due to increased risk.

Special Financing Programs

MBFS often offers promotional rates for new models.

Market Conditions

Economic factors, such as interest rates set by the Federal Reserve, can influence automotive finance rates. When interest rates are low, finance rates tend to be lower, and vice versa.

Impact of Interest Rate Fluctuations

Monitor economic indicators to anticipate rate changes.

Mercedes-Benz Finance Options

MBFS offers various financing options to meet different customer needs.

Traditional Financing (Auto Loans)

A traditional auto loan involves borrowing money to purchase a vehicle and making monthly payments until the loan is paid off. You own the vehicle outright after the loan term.

Key Features of Auto Loans

Fixed interest rates and monthly payments.

Leasing

Leasing involves paying for the use of a vehicle for a specified period. At the end of the lease term, you return the vehicle or have the option to purchase it.

Advantages of Leasing

Lower monthly payments compared to financing.

Disadvantages of Leasing

No ownership of the vehicle.

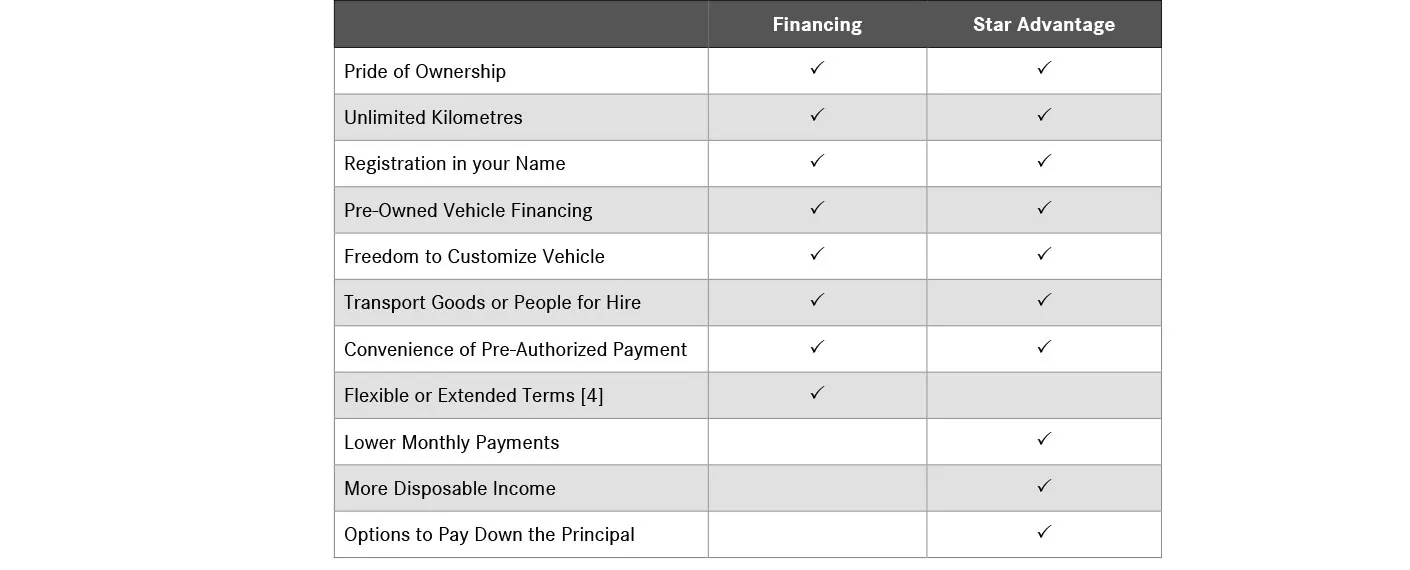

Mercedes-Benz Star Advantage Program

This program offers flexible financing and leasing options, including special rates and incentives for qualified buyers.

Benefits of the Star Advantage Program

Tailored financing solutions.

Certified Pre-Owned (CPO) Financing

MBFS offers special financing rates for CPO Mercedes-Benz vehicles, which have undergone a rigorous inspection process and come with an extended warranty.

Advantages of CPO Financing

Lower rates compared to used vehicle financing.

Tips for Securing the Best Mercedes-Benz Finance Rate

Here are some tips to help you secure the best possible finance rate.

Check Your Credit Score

Before applying for financing, check your credit score and address any errors or discrepancies. Knowing your credit score helps you understand your eligibility for different rates.

Resources for Checking Credit Scores

AnnualCreditReport.com (free annual reports from the three major credit bureaus).

Shop Around for Rates

Don’t settle for the first rate offered by MBFS. Compare rates from other lenders, such as banks and credit unions, to ensure you’re getting the best deal.

Benefits of Comparing Rates

Potential for lower interest rates.

Get Pre-Approved

Getting pre-approved for an auto loan can give you a better understanding of your budget and negotiating power. It also allows you to focus on finding the right vehicle without worrying about financing.

Advantages of Pre-Approval

Knowing your approved loan amount.

Consider a Larger Down Payment

A larger down payment can reduce your loan amount and potentially lower your interest rate. If possible, save up for a significant down payment.

Negotiate the Rate

Don’t be afraid to negotiate the interest rate with the finance manager. They may be able to offer a lower rate or other incentives to close the deal.

Negotiation Strategies

Come prepared with pre-approved offers from other lenders.

Review the Loan Documents Carefully

Before signing any loan documents, carefully review the terms and conditions. Ensure you understand the interest rate, loan term, and any fees or penalties.

Key Points to Review

Interest rate and APR.

Conclusion

Navigating Mercedes-Benz finance rates requires careful consideration and planning. By understanding the factors that influence rates, exploring different financing options, and following these tips, you can secure the best possible deal and drive away in your dream Mercedes-Benz. Remember, knowledge is power, and being well-informed will empower you to make the most advantageous financial decisions.